Federal bond yields, when inverted, normally signify an upcoming recession. That's something we've been anticipating for some time, so whether it's a predictor or confirmation, is anyone's guess. It's not the first time yields have inverted in the last year or so.

It's just something all investors should be aware of, and plan for accordingly. I think the overall market has priced in these facts already, with the DJIA down about 15%, the SP500 down 18%, the NASDAQ100 down 25%, and the Russell down 27%.

These declines are up from yearly lows, with rebounds of 5% to 10% in the last month or so.

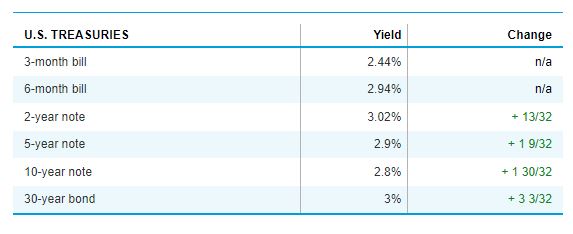

This chart shows the short term bonds have larger yields than the longer term 10-year and 30-year bonds. It should be the other way around.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.