Two common mantras of the Democratic party are 1) The "rich" don't pay their fair share of income taxes, and 2) the last tax cut signed into law by Trump was a tax cut for the rich.

Both are wrong, facts backed up by actual data from the IRS. While these Democratic party talking points keep getting repeated every year, the Democrats insist on perpetuating their lies in a type of class warfare.

1. The top 1 percent of wage earners pay 20 percent of income tax. The top 5 percent pay 35.9 percent and the top 10 percent pay 47.3%.

In 2019, the bottom 50 percent of taxpayers (taxpayers with AGI below $44,269) earned 11.5 percent of total AGI and paid 3.1 percent of all federal individual income taxes.

The top 1 percent (taxpayers with AGI of $546,434 and above) earned 20.1 percent of total AGI in 2019 and paid 38.8 percent of all federal income taxes.

I'm not sure what else could constitute "fair share."

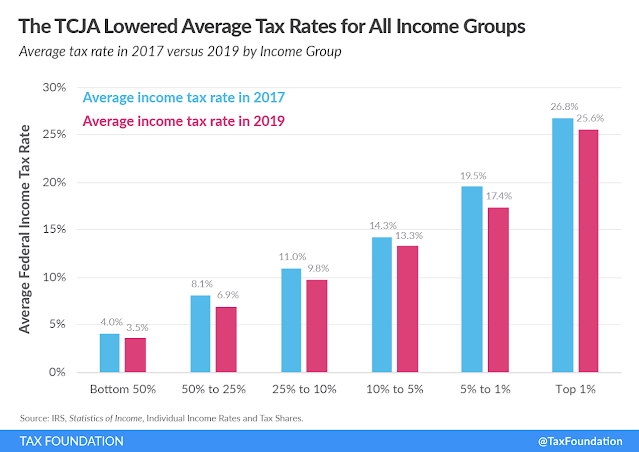

2. The Tax Cuts and Jobs Act (TCJA) reduced the average tax rate across all income groups.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.