President Biden at his State of the Union address vowed to fight inflation, though that has been a struggle, with consumer prices soaring 7.5% over the past 12 months.

Supply is in large part constrained because global supply chains have not healed from lockdowns. Supply chain problems are pushing prices higher because consumers have to pay more for scarce goods and businesses have to pay more for the inputs they need to produce these goods.

In the U.S., we have 4.6 million more job openings than workers to fill them. Businesses cannot make their products or provide their services at the levels necessary to meet demand without the appropriate number of workers. This is further exacerbating supply constraints. Additionally, businesses are having to pay workers substantially more to come to work, which is increasing their operating costs.

Clearly, businesses are raising prices because of market forces that are beyond their control.

Businesses raise prices when input prices rise. Both the prices of materials and labor are rising rapidly because of shortages and strong demand. Businesses can either see their margins shrink and start losing money, or they can raise prices to offset those higher costs.

In a broadly inflationary environment like we are in now, other businesses and consumers expect higher prices, so the market allows businesses to pass along their increased input prices. Their competition necessarily does the same. If a business refrains from raising prices, it will see its profitability suffer compared to others in its industry, even if it gains sales. These are the basic economic facts, and they reflect mere survival in competitive markets.

Plain old supply and demand play a large role here, too. If a business can only make a limited amount of its product because it does not have enough workers and cannot get the inputs to produce its product, but demand for the product remains robust, then market prices rise. That is what we are seeing now.

Those making the corporate greed argument need to grapple with the fact that businesses did not raise prices before COVID-19 or even during the height of the pandemic. Were they acting out of beneficence then? No, they were setting prices given market conditions – just as they are now.

High inflation (above the Federal Reserve’s 2% target) is likely to remain with us for some time, although likely not at the current 6% rate. It will come down through the middle of the year as supply chain problems ease and more workers come back to the labor force. We should see it dip to between 3-4% by the end of the year.

Inflation will remain high because the best tool for fighting inflation is through monetary policy, and there are substantial lags when it comes to implementing monetary policy to correct inflation.

Biden said during his speech before Congress: "My top priority is getting prices under control. We have a choice. One way to fight inflation is to drive down wages and make Americans poorer. I think I have a better idea to fight inflation: Lower your costs, not your wages. Make more cars and semiconductors in America. More infrastructure and innovation in America. More jobs where you can earn a good living in America instead of relying on foreign supply chains, let's make it in America. My plan to fight inflation will lower your costs and lower the deficit."

Even if making it (supplies?) in America would work, it would take several years, but that is not the underlying cause of inflation. Inflation is caused by two major factors: Too much money in the financial system and more demand than supply.

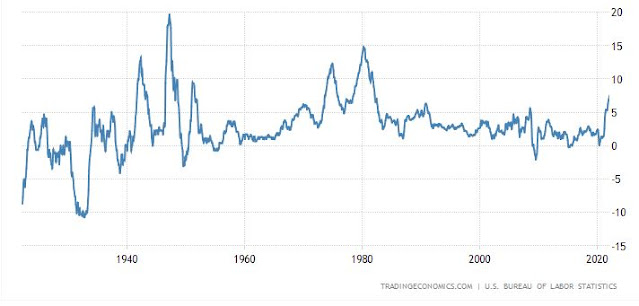

|

| U.S. Inflation Rate 1920 to 2022 |

The Federal Reserve has put approximately $5 trillion into the financial system since the beginning of the COVID-19 pandemic. This enormous sum is slowly trickling from the financial economy into the real economy, which is pushing the price of goods and services up. It will persist for a couple of years, even as the Federal Reserve moves to curb the effects. It was necessary to flood the financial system with liquidity to prevent a financial crisis during the pandemic, and inflation is an unintended consequence the Fed will have to deal with as the pandemic comes to an end.

Supplies of all types of goods are constrained for several reasons, but demand remains strong because consumers are still flush with cash from pandemic relief supplements. Since February 2020, spending on goods has grown 6-fold compared to spending on services. Spending on goods is up almost 30% while services spending is up only 5%. When demand rises faster than supply can keep up, prices rise.

Supplies of all types of goods are constrained for several reasons, but demand remains strong because consumers are still flush with cash from pandemic relief supplements. Since February 2020, spending on goods has grown 6-fold compared to spending on services. Spending on goods is up almost 30% while services spending is up only 5%. When demand rises faster than supply can keep up, prices rise.

Businesses raise prices when input prices rise. Both the prices of materials and labor are rising rapidly because of shortages and strong demand. Businesses can either see their margins shrink and start losing money, or they can raise prices to offset those higher costs.

In a broadly inflationary environment like we are in now, other businesses and consumers expect higher prices, so the market allows businesses to pass along their increased input prices. Their competition necessarily does the same. If a business refrains from raising prices, it will see its profitability suffer compared to others in its industry, even if it gains sales. These are the basic economic facts, and they reflect mere survival in competitive markets.

Plain old supply and demand play a large role here, too. If a business can only make a limited amount of its product because it does not have enough workers and cannot get the inputs to produce its product, but demand for the product remains robust, then market prices rise. That is what we are seeing now.

Those making the corporate greed argument need to grapple with the fact that businesses did not raise prices before COVID-19 or even during the height of the pandemic. Were they acting out of beneficence then? No, they were setting prices given market conditions – just as they are now.

High inflation (above the Federal Reserve’s 2% target) is likely to remain with us for some time, although likely not at the current 6% rate. It will come down through the middle of the year as supply chain problems ease and more workers come back to the labor force. We should see it dip to between 3-4% by the end of the year.

Inflation will remain high because the best tool for fighting inflation is through monetary policy, and there are substantial lags when it comes to implementing monetary policy to correct inflation.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.