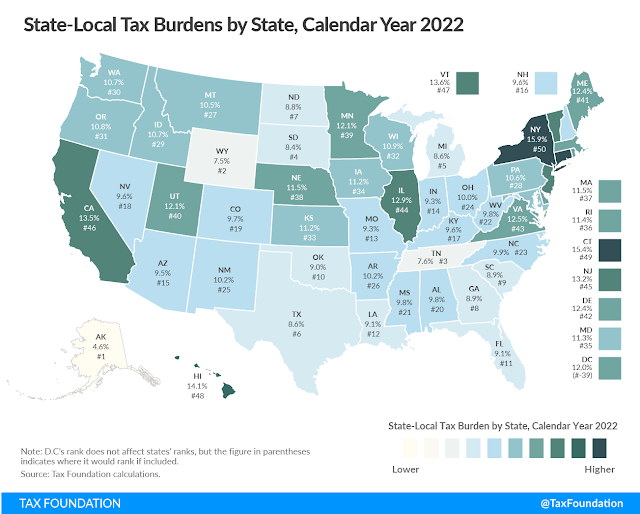

- In calendar year 2022, state-local tax burdens are estimated at 11.2 percent of national product.

- Taxpayers remit taxes to both their home state and to other states, and about 20 percent of state tax revenue comes from nonresidents. Our tax burdens analysis accounts for this tax exporting.

- New Yorkers faced the highest burden, with 15.9 percent of net product in the state going to state and local taxes. Connecticut (15.4 percent) and Hawaii (14.9 percent) followed close behind.

- On the other end of the spectrum, Alaska (4.6 percent), Wyoming (7.5 percent), and Tennessee (7.6 percent) had the lowest burdens.

- Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

- State-local tax burdens are often very close to one another and slight changes in taxes or income can translate to seemingly dramatic shifts in rank. For example, Oklahoma (10th) and Ohio (24th) only differ in burden by just over one percentage point. However, while burdens are clustered in the center of the distribution, states at the top and bottom can have substantially different burden percentages.

Source: Tax Foundation

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.