The untold story about “green energy” is that it can’t possibly be scaled up to provide anywhere near the energy to replace fossil fuels. (Unless we are headed back to the stone age – which is what some of the “de-growth” advocates favor).

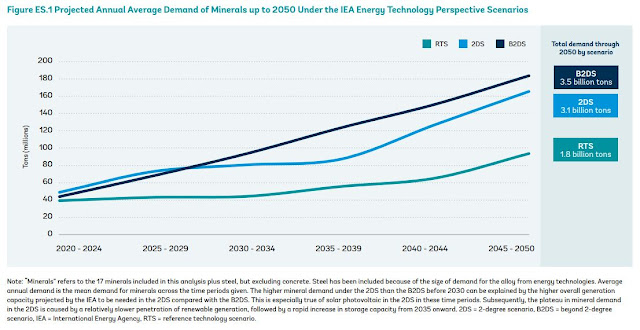

A new World Bank Group report finds that the production of minerals, such as graphite, lithium and cobalt, could increase by nearly 500% by 2050, to meet the growing demand for clean energy technologies. It estimates that over 3 billion tons of minerals and metals will be needed to deploy wind, solar and geothermal power, as well as energy storage, required for achieving a below 2°C future.

Recently, even some environmentalists are pointing to a the World Bank report showing that moving toward 100% solar, wind, and electric battery energy would be “just as destructive to the planet as fossil fuels.” This was the conclusion of a story in Foreign Policy magazine in 2019, The Limits of Clean Energy.

Recently, even some environmentalists are pointing to a the World Bank report showing that moving toward 100% solar, wind, and electric battery energy would be “just as destructive to the planet as fossil fuels.” This was the conclusion of a story in Foreign Policy magazine in 2019, The Limits of Clean Energy.

A low-carbon future will be very mineral

intensive because clean energy technologies

need more materials than fossil-fuel-based

electricity generation technologies. Greater

ambition on climate change goals (1.50C–20C

or below), as outlined by the Paris Agreement,

requires installing more of these technologies and

will therefore lead to a larger material footprint.

Moving to a “carbon free” energy future, according to the Foreign Policy article “requires massive amounts of energy, not to mention the extraction of minerals and metals at great environmental and social costs.”

Here are the estimates, of how much minerals would be needed:

Here are the estimates, of how much minerals would be needed:

- 34 million metric tons of copper

- 40 million tons of lead

- 50 million tons of zinc

- 162 million tons of aluminum

- 4.8 billion tons of iron

The report underscores the important role that recycling and reuse of minerals will play in meeting increasing mineral demand. It also notes that even if we scale up recycling rates for minerals like copper and aluminum by 100%, recycling and reuse would still not be enough to meet the demand for renewable energy technologies and energy storage.

However, the reports points out that the current supply of some minerals would need to be consumed (for example, 87 percent of aluminum) to meet demand for green energy, such as solar panels.

How this will affect world markets is yet to be seen, but can only be disruptive and inflationary, to say the least.

Comments

Post a Comment

Thanks for the comment. Will get back to you as soon as convenient, if necessary.